With inflation in the US now hitting 9.1%, everyone is feeling the economic sting to some extent. After emerging from two years of global pandemic into a desperate, power-hungry war in Ukraine and continuing economic chaos, is it a surprise that the cannabis industry is still booming? The world sucks sometimes, but getting high and playing video games always hits the same. But are things really all that good in the industry? Has inflation made weed cost more? Or has the continued popularity of weed helped legal states make ends meet? And finally, would federal marijuana legalization help the country out of this slump?

One thing is for sure: inflation has increased costs for basically every industry, and the marijuana industry is no different. Even if companies have kept prices consistent so far, it can’t continue indefinitely. And when prices rise: how will consumers react? Are dispensaries going to lose out as purse-strings tighten across the country?

These are big questions, and the answers aren’t easy to find – and in some cases, we really don’t know – but we’ve taken a deep-dive to address as many as we can. Through conversations with experts in economics, analysis of current and past trends, and a huge survey of around 1,500 American adults, we’ve gathered everything you need to know about cannabis and inflation.

The bad news for dispensaries is that sales will decline if the price increases, but the good news is that a lot of people will still buy, and if local governments are smart enough, they’ll see how legal cannabis can help pull us through times of economic hardship.

Table of Contents

Inflation and the Cannabis Industry

The Survey: How Inflation Impacts Cannabis Consumers

77% of Respondents Have Been Negatively Affected by Inflation

57% of Users Believe Cannabis Prices Have Increased Compared to Last Year

42% of Users Bought The Same Amount of Cannabis This Year as They Did Last Year

28% Said Inflation Was the Reason They Changed The Amount They Bought

29% of Weed Smokers Have Bought in Bulk to Save Money

46% Still Wouldn’t Change The Amount They Buy if Inflation Gets Worse

54% Would Buy Less if Weed Prices Rose Due to Inflation

83% of Weed Users Would Be Willing to Pay $30 an Eighth (3.5 g)

44% Would Dine Out Less to Afford More Weed

57% of Dispensary Customers Would Buy Less if Weed Prices Increase

51% of Daily Smokers Would Still Buy the Same Amount Even With More Inflation

57% of the Most Financially Affected Would Cut Down on Weed if Inflation Continued

Legalizing Weed at the Federal Level Would Bring in $128.8 Billion in Taxes Alone

30% of Dispensaries Will Raise the Price Due to Inflation – Can The Industry Survive Otherwise?

What the Government Needs to Do

Key Findings

- We polled 1,450 Americans who use cannabis about inflation, what differences they’ve noticed and whether their behavior would change if the situation worsens.

- Despite some state-level data suggesting stagnation or even declines in cannabis prices, 57% of respondents said prices have increased since last year.

- Over the past year, 42% of respondents said they’d continued buying the same amount of cannabis, compared to 35% who have increased their use and 23% who’ve decreased it.

- The people who’ve changed the amount they buy gave a variety of reasons. The most common was health/lifestyle reasons (29%), but 28% cited inflation specifically and 26% said the economy generally.

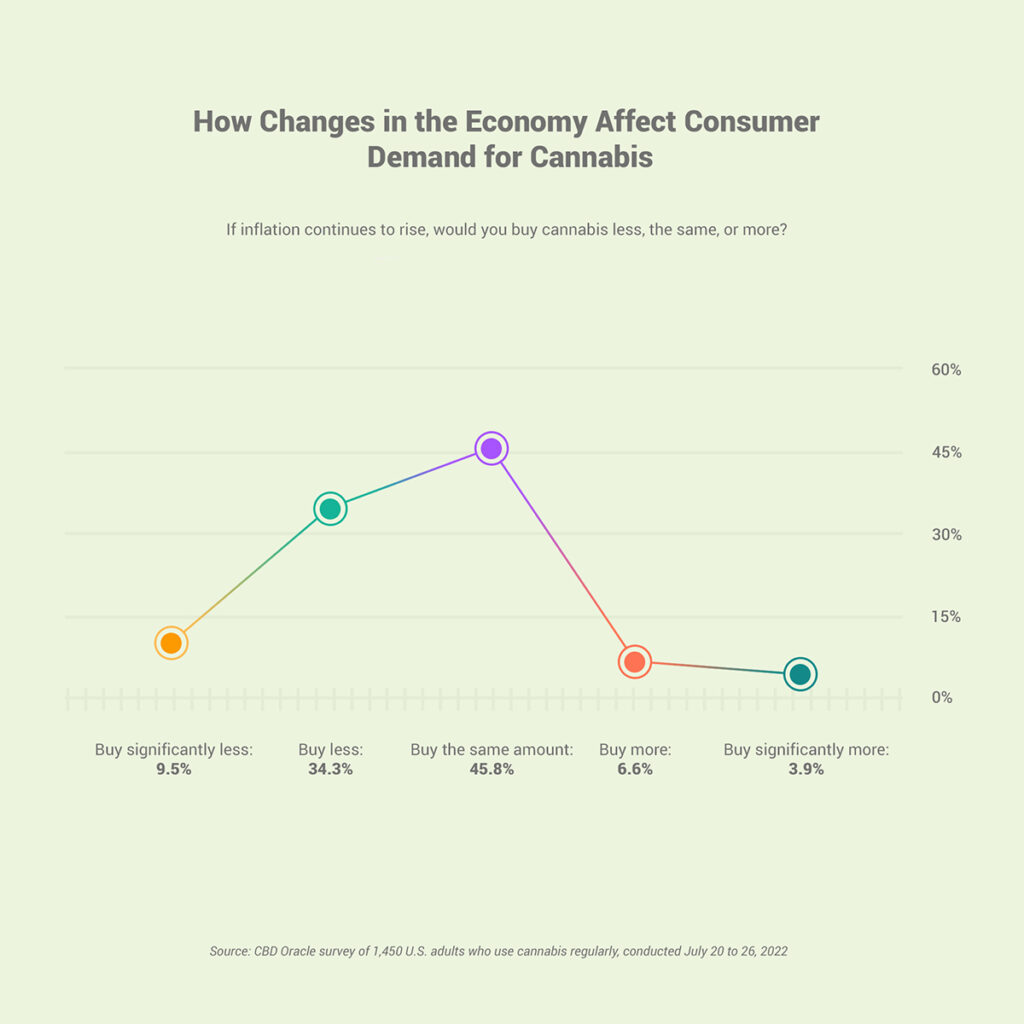

- If there was more inflation, around 46% of respondents would buy the same amount of cannabis, 44% would buy less, and the remainder would buy more.

- People have saved money on weed by (in order of popularity): buying in bulk, buying cheaper weed, only buying if there’s a sale or by cutting down.

- If dispensaries increased the prices of weed, 54% would buy less, 37% would buy about the same and 9% would buy more.

- Generally, $30 to $40 was the most people would be willing to pay for an eighth (3.5 g). Around 57% would still be happy at $40 an eighth, and 83% would still pay $30.

- 44% of people would give up or cut down on dining out to afford more weed, compared to 38% who’d give up entertainment and going out, 29% who’d give up alcohol or tobacco and 28% who’d cancel Netflix.

- Everyday smokers are more likely to purchase consistent amounts even if prices increased, with 51% saying they’d buy the same amount.

- Consumer behavior depends a lot on how affected they are by inflation. 57% of those most affected would cut down on weed if inflation continues, while for those least affected, 57% would buy the same amount.

- By creating jobs, tax revenue and because most of the supply chain is confined within a state, the experts we spoke to believe that cannabis legalization will benefit local economies in difficult times.

The Basics of Inflation

Before we get into the specifics of inflation as it relates to cannabis consumers and sellers, it’s important to have a general idea of what we mean when we talk about “inflation.” In a nutshell, it describes the effective devaluation of a currency by a reduction in its purchasing power. Things get more expensive, so your dollar gets you less of whatever you want to buy. Prices inflate and all of a sudden your paycheck doesn’t make ends meet anymore.

There are three basic causes of inflation that can help us understand where it comes from. Firstly, if people have more money, they demand more goods, and if supply can’t meet this demand, prices will increase accordingly. This is called the demand-pull effect. Secondly, if production costs increase for any one of many possible reasons, these additional costs are pushed over to consumers, which is called the cost-push effect. Finally, if people (generally correctly) expect inflation to rise, they may demand increases in wages to account for this, which in turn leads to rising prices to cover costs. This leads to further wage increases and the cycle continuing, which is known as built-in inflation.

There are different price indexes used to measure inflation, but the most well-known (and the one we’ll refer to here) is called the Consumer Price Index (CPI). This is basically the price of a “basket” of goods that includes things like food, transportation and medical care, expressed as a relative percentage change between two specific dates. This is also a weighted “basket,” so the impact of a price increase on a less common good has less of an impact than the same increase on a very common good. From June 2021 to June 2022, this basket has increased in price by 9.1%, with the majority of the change coming from differences in energy costs.

Inflation and the Cannabis Industry

Despite inflation affecting basically every aspect of life, there have been reports that the cannabis industry has been unaffected by these pressures so far, at least if you consider end-prices. In fact, it’s been suggested that cannabis is “inflation proof” as a result of this.

However, things are a little bit more complicated. Prices aren’t only dependent on inflation, as Andrew Livingston, Director of Economics & Research at Vicente Sederberg, explained:

“In large part, companies are not increasing their prices even though they are experiencing an inflation in their expenses (labor, non-cannabis input ingredients, cost of capital, etc) because the pressures of supply and demand within the cannabis market are acting in a stronger way to push down prices than inflation is placing on production costs.”

He points out that the pandemic was a relative boom for the cannabis industry, and that they responded to the increased demand by increasing production, but now the pandemic is essentially over, things are changing. He continues:

“Over the last few months demand has waned as consumers rebalance their purchases across products and experiences and reduce both as inflation cuts into their pocketbook. With supply remaining at its pandemic high and demand falling, an oversupplied legal cannabis market puts downward pressure on prices.”

He condensed the same overall point to CNN, stating that if prices don’t rise, “it doesn’t mean that there’s no inflation. It means there are other factors at work that would overwhelm the inflationary signals.”

The common wisdom is that this is what’s going on with the cannabis industry right now. Colorado is used as an example: with a mature recreational market and being essentially prohibited from doing anything out-of-state, there is a strong in-state supply chain that more than meets demand. Sure, the gas cost from the farm to the dispensary is higher, but this is a very different issue to getting grains out of war-torn Ukraine, for instance. Their costs are higher, but not high enough to risk losing customers.

But it’s also pointed out that this can’t continue indefinitely. With prices from suppliers reportedly increasing by up to 30%, small and medium-sized businesses can’t take this hit for too long without passing some of it onto consumers. There is understandable fear because competitors may not increase prices too and street dealers could always make a comeback, but it may reach a point where companies may not have much choice. So what would consumers do in that case?

The Survey: How Inflation Impacts Cannabis Consumers

Our survey aimed to address the issues surrounding inflation and cannabis from a consumer’s perspective. In particular, we asked respondents (who all used cannabis) about how their consumption habits have changed over the past year, whether they’ve changed where they buy, the reasons for any such changes and whether they’ve personally noticed an increase in prices.

The survey was conducted through Pollfish, with a total sample of 1,450 Americans in adult-use states who consume cannabis regularly. Although the sample was broadly representative of the US population anyway, the results have been post-stratified, meaning they’re weighted to be more representative of the population. The methodology section at the bottom has more information about the poll and how the results were analyzed.

You can look at all of the results of the survey here, and we’ll describe the most important results below.

How Affected Have the Participants Been By Inflation?

77% of participants have been negatively affected by inflation.

Before getting into the details of what the participants think about cannabis and inflation, it’s a good idea to look at how they’ve been impacted by inflation so far. Somewhat expectedly, the vast majority of participants (77%) have been negatively affected by inflation, either slightly (46.0%) or greatly (31.0%). An additional 11.8% had not been affected, 8.8% said their situation had improved and the remaining 2.4% would rather not say.

Have Cannabis Prices Been Rising?

Despite a 17% reduction in prices, 57% of people believe that prices have increased in the past year.

This is a difficult question to answer conclusively with up-to-date information, but the combination of our survey results and real-world data paints an interesting picture.

Firstly, based on Headset data covering the period between January 2021 and January 2022, prices per mg of THC have declined in California, Colorado, Michigan, Nevada, Oregon and Washington, by 16.7% for flower. More recent reports from states such as Colorado also describe a decline in the price. The Cannabis Spot Index also shows decreases in the price over the past year.

However, in our survey, consumers were more split on their perception of cannabis prices. In fact, an adjusted 57.3% said that prices had increased compared to last year, with the majority (43.6%) saying that it has increased but not by a lot. In contrast, just 34.5% said the price had stayed the same, and just 8.2% said it had decreased.

This may reflect the difference between perceptions and reality, but in practice, the data we have isn’t necessarily accurate, particularly for prices in-store right now.

Are People Buying Less Cannabis?

Even with inflation, 42% of adult cannabis users report buying about the same amount this year as last year.

Despite prices being at least close to stable, you might expect people to still be buying less cannabis with the state of the economy. It’s a luxury, the argument would go, and so in difficult times people will cut down. Or alternatively, you might say that with the added stress from inflation and an impending recession, people would buy more cannabis to cope. So which is the case?

Well, it’s probably a bit of both, depending on who you ask.

Overall, the results from the survey show that the majority of people bought about the same amount of cannabis this year compared to last year, with 41.8% responding this way. However, 35% of respondents said they bought either a little more (21.6%) or a lot more (13.4%), compared to 23.3% who bought less, either a little (16.9%) or a lot less (6.4%).

This is in agreement with projections, too. For example, research firm BDSA projects that legal sales will increase by approximately 22% in 2022, and others make similar forecasts.

Why Have People Changed Their Habits This Year?

29% changed for health/lifestyle reasons, 28% because of inflation.

While we may assume the economy is the reason for changes in the amount of cannabis people buy this year, it might not be the case. We asked the respondents in the survey to give reasons for any changes in their use of weed this year, and found that economic reasons were indeed an extremely common explanation.

Although the most common specific answer from the survey was “health or lifestyle reasons” – given by 29% of respondents – the economy features very heavily in the top five reasons. These were:

| What has contributed to changes in your cannabis consumption this year? | (%) |

|---|---|

| Health or lifestyle reasons | 29% |

| Inflation and rising prices | 27.9% |

| Emotional or psychological needs | 26.8% |

| Financial hardship or economy | 25.8% |

| Weed prices have gone up or down | 22.1% |

There is, of course, some overlap here because the people who chose inflation/rising prices can also have chosen financial hardship/economy, but it still paints a picture of the main issues on people’s minds. This also aligns pretty closely with a New Frontier finding that price is the third most important factor they consider when shopping for cannabis.

Have Weed Buying Habits Changed Recently?

41% of regular cannabis users have cut down their spending recently, with 39% spending a consistent amount.

Although inflation has been rising for some time, most people are really starting to feel the pinch in recent months, so we also asked the participants whether they’d changed their spending on cannabis recently. Perhaps unsurprisingly, 41.1% of respondents said they’d reduced their spending on cannabis in the past year, either slightly (29.3%) or significantly (11.8%). In contrast, 39.0% spent the same amount, and the remainder either bought more (15.9%) or significantly more (3.9%).

Again, we see a lot of resistance to changing habits, despite the financial situation. However, in this case the most common answer was that spending has decreased, despite a similar percentage spending a consistent amount. This is one of many signs to come out of this survey that weed purchases are one of the things people consider cutting when finances get tight.

What Have People Done to Save Money on Weed?

Weed users save money by buying smarter rather than cutting down – 29% buy in bulk.

Even though weed prices are basically stable or have only increased a little, it’s clear from the last result that increased prices in other areas may impact how much weed people buy. But if people want to keep buying the same amount of weed – or even possibly more – how are they still making ends meet? We asked the participants what they’d done to save money when it comes to buying cannabis.

The most popular answers are as follows, noting that people could choose multiple options for this question (so the sum of percentages won’t equal 100%):

| How people are saving money on weed | (%) |

|---|---|

| Buy in bulk | 29.1% |

| Buy cheaper cannabis | 27.3% |

| Buy only if there’s a sale or promotion | 24.5% |

| Cut down on my cannabis use overall | 23.3% |

| Buy from family or friends | 22.3% |

| Buy from a dispensary | 22.2% |

| Grow my own at home | 18.0% |

| Use cheaper alternatives like CBD or delta-8 THC | 16.7% |

| Buy from a dealer (black market) | 15.0% |

With the remainder saying that they don’t need to save money and a small number giving “other” responses such as cutting other costs or using concentrates.

It’s especially noteworthy that using the black market is the least common answer from the nine given above. It seems that in legal states, other options such as growing your own or even just waiting for a sale at the dispensary are far preferred to returning to the black market.

Would More Inflation Change People’s Buying Habits?

46% of weed users wouldn’t change the amount they bought if inflation got worse.

Although the inflation we’re experiencing at present hasn’t changed most people’s weed buying habits, if things got more extreme, would it make a difference to cannabis users? Our survey suggests that 45.8% of weed users wouldn’t change the amount they bought. This is undoubtedly one of the things that contribute to people thinking that cannabis is “inflation proof” or “recession proof” as an industry.

However, the responses do show a definite trend towards buying less in the case of inflation or recession. In fact (to one decimal place), 43.7% of cannabis users would either buy less (34.3%) or a lot less (9.5%). In contrast, just 10.5% would buy either more (6.6%) or a lot more (3.9%). This shows that there is some economic sensitivity, and really the split between buying the same and buying less was pretty even.

If Cannabis Prices Rose Because of Inflation, Would People Buy Less?

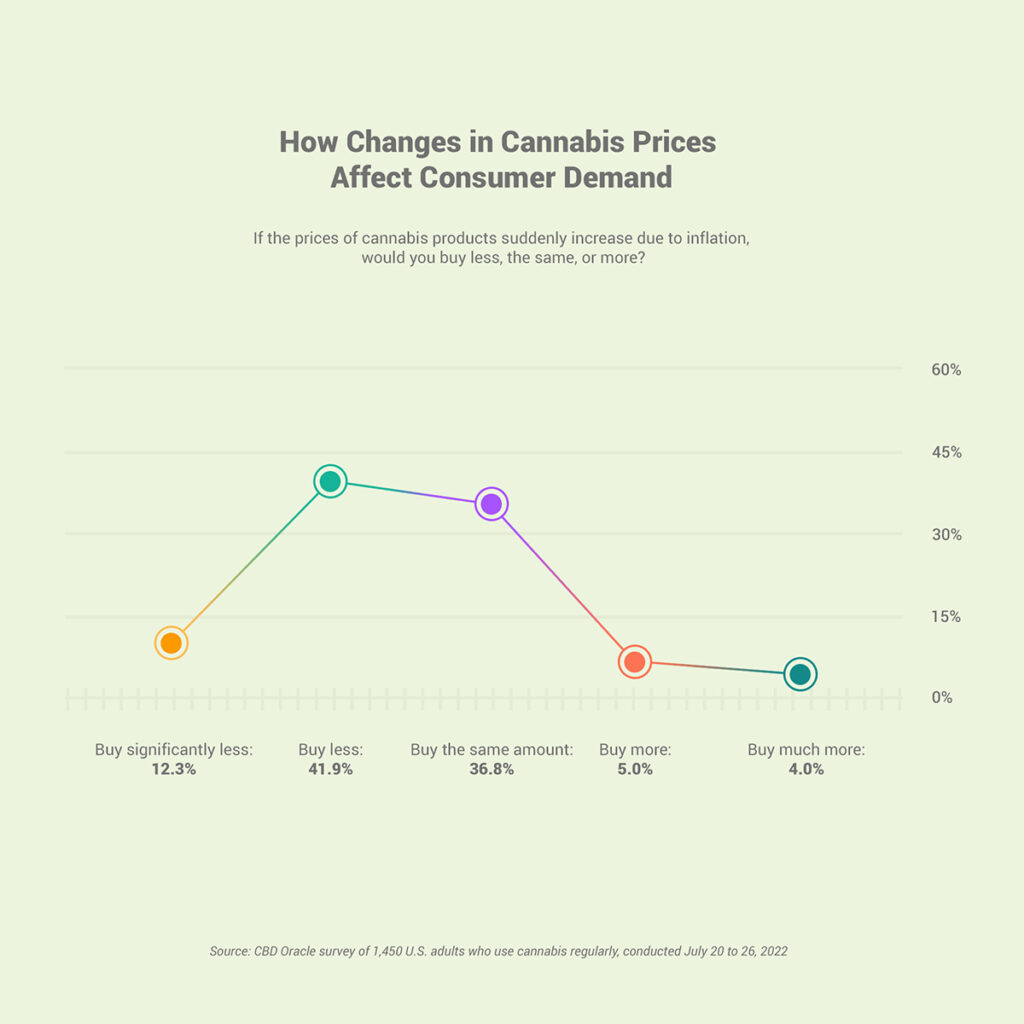

54% of regular cannabis users would buy less if prices increased due to inflation.

So while more inflation in general doesn’t seem like it would affect people buying weed, what if companies did actually increase prices to offset their inflation-related losses? Unfortunately, in this case our data suggests that 54.2% of cannabis users would buy either less (41.9%) or a lot less (12.3%). In contrast, 36.8% would buy the same amount, and just 9% would buy either more (5.0%) or much more (4.0%).

Recent evidence suggests that around 30% of dispensaries will be increasing prices for this reason very soon, so they can expect some decline in sales as a result. The level of decline depends on a few things, but notably, how much prices are raised (up to 10% is the report) and whether people’s intention to cut down materializes as actually cutting down or not.

What’s the Most People Would Be Willing to Pay for an Eighth?

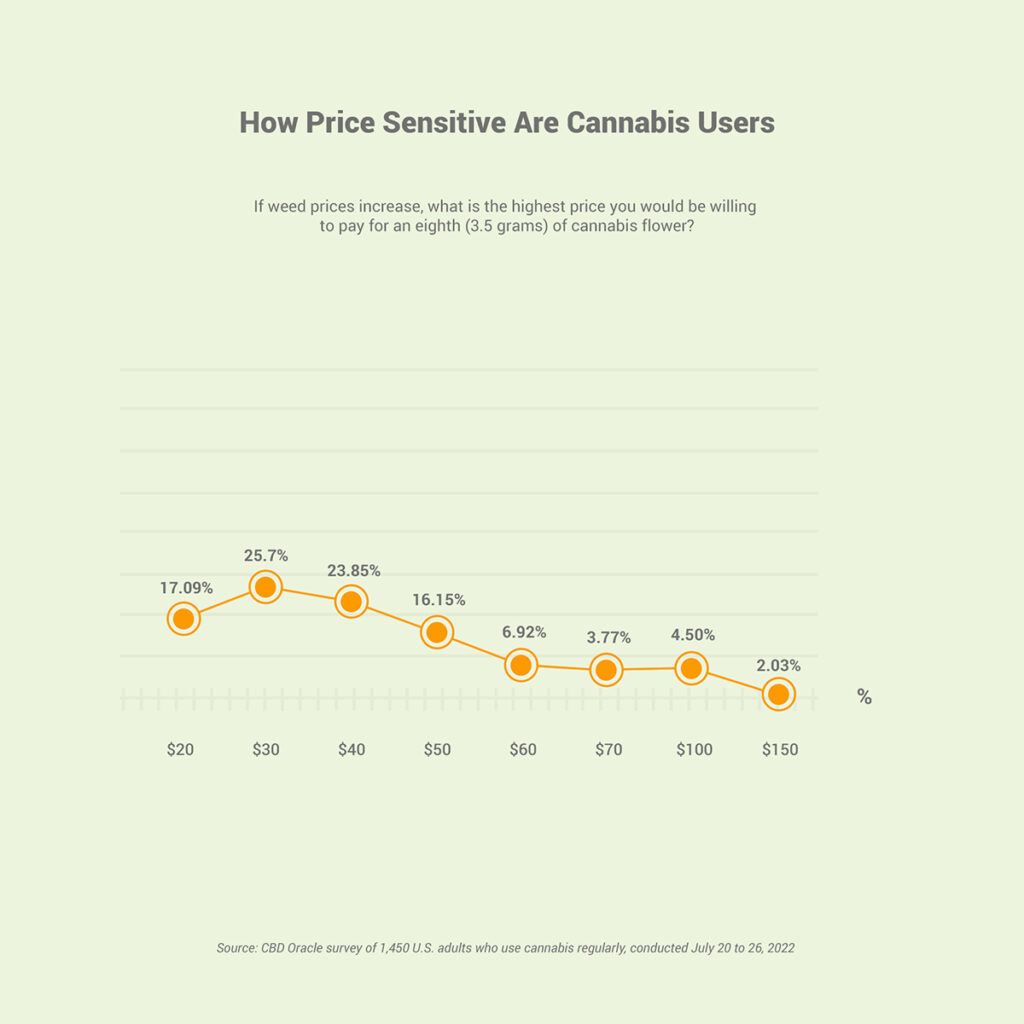

83% would be happy to buy at $30 an eighth, compared to 57% at $40 an eighth.

If weed prices were to increase, how much do people see as too much? Using an eighth of an ounce (3.5 g) as a benchmark, we asked people how much they’d be willing to pay. The results are:

The difference from a total of 100% here is just a small rounding error.

The data shows a peak around $30, but even if prices were raised to $40 an eighth, 57.3% of consumers would still buy. They would probably buy less, but they would still be willing to buy. In contrast, 83% would still buy at a maximum price of $30. This gives dispensaries some ability to raise prices, although it should be stressed that there is clearly a reasonable amount of price sensitivity for cannabis users in 2022.

The survey mentioned in the previous section found that they would increase prices by up to 10%, so it will likely still be seen as a reasonable price overall.

What Would People Give Up to Be Able to Buy More Cannabis?

44% would give up or cut down on restaurants and dining out to be able to buy more cannabis.

So far, the data has suggested that people have some – understandable – resistance to reducing the amount of weed they use, but that rising prices would cause issues for some. The question then naturally comes, if you can’t save enough by doing things like buying in bulk or growing your own, what would you give up in favor of cannabis?

We asked the participants to select all of the things they’d give up or cut down on to be able to afford more cannabis. The results were:

| What people would give up to afford more weed | (%) |

|---|---|

| Restaurants and dining out | 44.1% |

| Entertainment and going out | 38.4% |

| Travel and vacation | 31.8% |

| Alcohol or tobacco | 28.9% |

| Media subscriptions (e.g. Netflix) | 28.4% |

| Gadgets and tech | 27.3% |

| Big household purchases | 27.3% |

| Gym membership | 26.5% |

| Clothing | 25.1% |

| Charitable donations | 21.0% |

| Buying gifts for friends and family | 19.9% |

| Nothing | 14.7% |

| Books and education | 13.3% |

| Food and groceries | 11.5% |

| Prescription drugs | 9.3% |

| Utilities | 6.4% |

In short, almost half of people would cut down on eating out to afford more weed, with going out and entertainment shortly behind. Beyond these types of luxuries, people get much less likely to give up more serious expenses, such as clothing (just a quarter) or groceries (11.5%). It’s clear that while some non-essentials would be traded in for weed, more important expenses are much less likely to be replaced.

While most people wouldn’t give up something like their prescription medication or food and groceries to afford more weed, it’s important to note that those who would are probably somewhat addicted to cannabis, unless they have a serious medical need. Although it isn’t very addictive, we need to remember that it can be addictive.

Will Dispensaries Suffer if Prices Rise?

57% of dispensary customers would buy less if cannabis prices increase.

Based on the results discussed so far, it seems like dispensaries will be OK – though not great – if weed prices have to increase. However, these results also included people who get their weed from other sources, such as street dealers, growing at home or from family and friends. Just looking at the people who normally purchase from dispensaries:

- 43.2% of dispensary customers said they’ve bought the same amount of cannabis this year as last, while 34.7% said they bought more.

- 56.3% said they thought the price had increased over the last year, with 35.0% saying it’d stayed the same.

- 56.6% said they would buy either less (44.7%) or significantly less (11.9%) if the prices of cannabis products suddenly increased, compared to 36.7% who said they’d buy the same amount.

- The breakdown of the maximum prices dispensary shoppers would pay is similar to the overall group, although up to $40 was the most common answer, with 26.1% saying they’d pay this much, although 25.7% would draw the line at $30.

It’s hard to avoid the conclusion that dispensaries will lose money if prices increase. People are directly responsive to the price of weed, but even rising costs elsewhere can have an impact. However, a substantial percentage of people say they’ll continue to buy the same amount, and people seem open to paying a little more per eighth. So while times will be hard as the economy recovers, there will still likely be enough custom to stay afloat.

How Do the Heaviest Smokers Compare to Casual Users?

51% of daily smokers would still be the same amount if inflation continued to rise.

Although all of the participants in the survey smoked cannabis every week, some used every day while others used weed only one or two days a week. These groups are understandably quite different, and the variation between their answers gives an idea of the differences between lighter and heavier cannabis users.

- People who smoke every day are more likely to have increased their cannabis use over the past year, with 38.9% saying they increased vs. 24.9% of those who only used one or two days a week. Conversely, less frequent users were more likely to have decreased (31.1% vs. 19.9%).

- For the people who smoke every day, the most prominent reason for any change in use was health or lifestyle reasons, while for those who smoked just one or two days a week, the most common reason was financial hardship and the economy.

- If inflation were to continue to rise, 51.3% of daily smokers said they would buy about the same amount of cannabis, compared to just 36% of less frequent smokers, who were more likely to say they’d buy less.

- Of those who use cannabis every day, 49.2% would cut down on restaurants and dining out to afford more cannabis, compared to 43.4% of those who use less frequently. While both figures are around the average for the whole group, almost half of daily smokers would trade dining out for buying more cannabis.

How Do People With Financial Difficulties Compare to Those Without?

57% of those most affected by inflation will buy less weed if inflation continues.

For a better look at the impact of inflation, it’s worth looking at how some key results differ for people who were greatly affected by inflation compared to those who either weren’t affected or actually benefited. This analysis excludes the 43.7% of participants who were only slightly affected, to look at the biggest differences by financial situation.

- For the people most affected by inflation, they’re pretty evenly split between buying less (33.3%), buying about the same amount (31.2%) and buying more (35.6%), while the least affected are mainly buying around the same amount (42.9%) or buying more (39.0%), with just 18.1% buying less.

- The most common explanation for changes in their habits from the people unaffected are health/lifestyle reasons (34.4%) and emotional/psychological needs (30.7%), whereas from those the most affected, it’s financial hardship (44.5%) and inflation (41.7%).

- If inflation were to continue to rise, 57.2% of those most affected by inflation so far would buy less cannabis, compared to just 21.5% of the least affected. For the least affected, 57.4% would buy the same amount regardless.

- While both groups would choose restaurants and dining out as the first expense they’d cut to afford more weed, only 29.5% of those least affected would do this, compared to 52.2% of those most affected.

Does the Cannabis Industry Protect Local Economies? Experts Say it Helps

Inflation increases by 5% in states without legal weed, compared to those with it.

Although it might not seem like the most likely hypothesis at first glance, with a little thought, you see why it should be taken somewhat seriously. If, as the poll suggests, economic hardship doesn’t substantially affect the amount of weed people buy, and states collect taxes on these legal purchases (not to mention dispensaries and farms keeping people in jobs), then it’s entirely possible for cannabis to be a boost to local economies in times like this.

Andrew Livingston from Vicente Sederberg agreed:

“Yes, cannabis sales will benefit local economies as the money spent on cannabis goes on to pay employee salaries, local contractors, and suppliers. Because all cannabis sold in a state must be produced in the state, cannabis commerce has a greater economic multiplier than most other industries. The cannabis products sold in a Denver retail store are much more likely to be cultivated, extracted, and manufactured in Denver than the goods sold at an ordinary Denver convenience store.”

In short, all of the money spent on cannabis stays in-state, so it makes sense it will have a bigger impact on local economies than other industries, if all else is the same. We spoke to Dr. Chris Erickson, Interim Department Head and Professor of economics at New Mexico State University, who discussed the “stabilizing” effect a thriving cannabis industry can have on a local economy:

“The ability of the cannabis sales to insulate an economy from a recession depends on how cannabis sales respond to a decline in income. The sensitivity of products to a recession varies. The evidence as to how cannabis sales will vary with changes of income is limited, but what I could find indicated that cannabis sales are relatively stable. This means, all else the same, if a local economy has a relatively large cannabis sector, it will be more stable. Of course, there can be many compounding factors.”

From our survey, it does seem that people buy cannabis at a reasonably consistent rate in times of economic hardship, and so it’s likely that any local economy with a cannabis sector will be more resistant to other changes. As Dr. Erickson commented, it can have a stabilizing effect on a local economy. Andrew Livingston pointed out that this is very dependent on the relative size of the cannabis industry for the local economy:

“The degree of the stabilizing effect depends on the size of the local economy. With a small economy cannabis sales and taxes may represent a large portion of local commerce and if those sales stay strong it could help to stabilize the town’s economy in a significant way. For larger cities like Denver or Los Angeles, cannabis commerce makes up a much smaller percentage of the total city GDP and as such will have a stabilizing effect, but it will be much smaller given the size of the market.”

Dr. Erickson also pointed out that the impact on the local economy depends strongly on the specific location as well, with factors like cannabis tourism having a notable impact.

“For some locations, cannabis can contribute significantly to the local economy. In this regard, often cited are stores located near jurisdiction boundaries where only one jurisdiction has legalized cannabis. Cannabis sales to tourists can be a significant source of income to the local community.”

So with all of these ways in which a thriving cannabis industry can be a boon to the local economy, is it really the case that legal states are doing better than more restricted states?

Unfortunately, this isn’t exactly easy to determine, and lists of things like the cities with the highest and lowest levels of inflation don’t provide enough information to really get to the bottom of it. So, using the data from the U.S. Bureau of Labor Statistics, we found the inflation rate in each state and grouped them by whether or not they have legal recreational cannabis. Although this isn’t perfect – for instance, there isn’t specific data for many states – it gives a much better picture than we can find otherwise. Where the data was more fine-grained, we opted for the capital or another large city in the state as a benchmark, and the comparison was for the previous year, up to either May or June this year.

The results showed that states with legal cannabis do indeed have lower levels of inflation, although the absolute difference is pretty small. States without legalized cannabis had an average of 9.33% inflation over the previous year, compared to 8.86% for states that have legalized weed. In relative terms, this is 5% higher inflation in states without legalized weed compared to those with it. If this is a genuine effect – rather than a chance finding – it does seem that having a marijuana industry could have some positive effects in difficult economic times such as this.

Other data also shows the impact of the pandemic on employment, broken down by state. By comparing the change in employment from February 2020 to September 2021 in states that had legalized recreational marijuana before 2021 vs. ones that hadn’t, we were able to see whether having a cannabis industry had a notable impact on jobs. It doesn’t seem so from the results – a decrease of 4.6% for legal states compared to one of 3.6% for non-legal states – but it’s important to remember that the industry can only employ so many people, and this generally limits its ability to make a big difference. Again, the size of the overall economy affects how much of an impact a cannabis industry can have.

Could Legalizing Cannabis Help the US Economy in Times of Inflation and Recession?

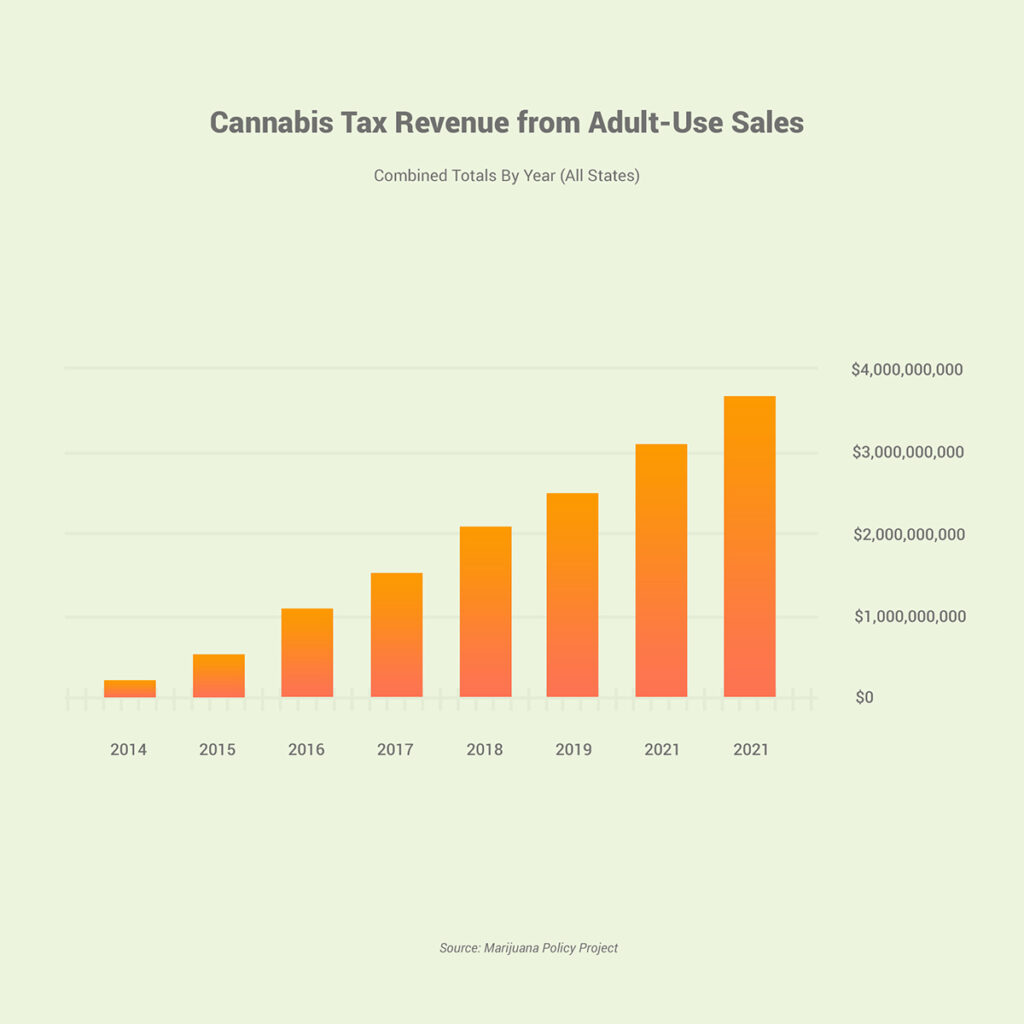

Legal weed at the federal level would bring in $128.8 billion in taxes alone.

With inflation still on the rise and recession seemingly on the horizon, there might be a stronger argument than ever for legalizing cannabis. As in the states that have legalized it so far, cannabis could be another source of income and jobs for people in the state, and it would lead to huge savings in enforcing the federal ban on marijuana.

Tax revenue is the most obvious benefit of cannabis legalization, and one of the strongest arguments for it. In the states that have already legalized recreational marijuana, in 2021, they generated over $3.7 billion in tax revenue alone. This is just from the states that have legalized it and begun sales so far, and the figure, if we legalized at the federal level, would be much higher. In fact, New Frontier estimates that the total tax revenue alone would reach $128.8 billion, over a period of around seven years and assuming a 15% retail sales tax rate.

The tax revenue also isn’t the only thing to consider. The most important secondary issue is jobs. There are currently around 6 million people out of work in the US, after a quick recovery from the spike due to coronavirus. In contrast, the US cannabis industry currently supports over 428,000 jobs, according to Leafly. New Frontier projected that if cannabis had been legalized at the federal level in 2019, there would be 1.63 million jobs in the industry by 2025. This would support over a quarter of all unemployed people in the country.

There are other financial benefits too. Firstly, the ability of marijuana companies to trade on the public stock exchange would create new investment opportunities and generate a lot of wealth in the process. The amount spent on enforcing the basically-useless federal marijuana laws would also be saved. With the vast majority of Americans living somewhere where it’s theoretically possible to access cannabis legally, any impact would be minimal and the benefits would be massive.

Writing for Forbes in 2020, Kris Krane drew a parallel between alcohol prohibition in the 1920s and marijuana prohibition today. The Great Depression was causing economic turmoil, and thanks to speakeasies and organized crime, alcohol was still basically available to those who wanted it. It’s estimated that the federal government lost out on $11 billion in alcohol-related taxes during the prohibition years.

Repealing prohibition wasn’t the solution to the Great Depression, but it gave a much-needed cash injection into the economy – to the tune of $1.35 billion in the first full year following repeal – that enabled New Deal projects that further boosted the economy. With the US seemingly headed for recession in the next year, legalizing cannabis could give the economy a similar kick and give Biden additional funds for projects to further lessen its impact.

In Forbes, Krane continues the argument by outlining the injustice of criminalizing cannabis use (creating new Al Capones all around the country) and the huge benefit of police being able to focus on actual crimes with actual victims. But we don’t need to do that here; the arguments for legalization are so clear that a majority of US citizens already support it. Biden might not have historically been the biggest supporter of cannabis, but with the tide moving towards legalization being this strong, why would you continue swimming against the current?

Can Dispensaries Survive Inflation Without Raising the Price?

30% of dispensaries are planning on increasing prices very soon.

As our poll shows clearly, inflation impacts consumers by limiting the amount they have to spend and possibly pushing them to cut down on cannabis purchases altogether, but it’s especially brutal for companies. Andrew Livingston explained to us that:

“Cannabis is clearly not “inflation proof.” Companies struggle to operate profitably as their cost of labor, distribution, and input ingredients climb along with prices across the rest of the economy.”

Adding that, “While additional data is needed to prove this hypothesis, I believe the cause of downward wholesale prices will vary state to state. Michigan and Arizona are both experiencing price declines but they have very different license structures and license limitations. In states with somewhat static or limited new licenses, downward pressure on prices is likely due to increased production from existing competitors and waning demand than it is due to additional competitors in the market.”

Leafly argues that weed prices are staying the same despite inflation for a few different reasons.

One of the most important is an oversupply of cannabis. Inflation is caused by an abundance of demand and limited supply, but in the case of weed, the supply is outpacing the demand. This means that customers have tons of choice and any dispensary raising their prices would likely be immediately dropped for one that kept prices the same. As Jason McKee, from Ganja Goddess in Seattle, commented to Leafly that:

“Any one of the shops who raises their prices on their own, [it] would be a little bit of a death sentence at this point. Customers know that they have a lot of options.”

Similarly, Alex Manzin of Bud’s Goods and Provisions, a Massachusetts-based chain, commented to Grown In that:

“It’s sort of a perfect storm in Massachusetts where it’s finally getting an oversupply of product into the market along with this inflation pricing on everything else, which causes more people to go back to the legacy markets. I think ultimately consumers are not saying, ‘Oh, I’m not going to consume cannabis.’ But what they are saying is ‘I’m going to a new source to get it at a lower price.’”

It’s important to note here that when he says “legacy markets,” he means black-market dealers.

The abundance of consumer choice isn’t the only problem for dispensaries and the growers they depend on. The continuing disruption to the global supply chain is also causing huge issues for growers, with increases in costs for fertilizer (which have increased about 25% in just a few months), fuel and even things as simple as pots to grow plants eating into their profits.

This would be manageable for growers if dispensaries were paying more for the crop, but with competition among growers too, the real impact of this is profit margins shrinking and often totally disappearing. MJBizDaily points out that the wholesale cost of a pound of marijuana flower in Colorado has fallen from $1,600 to $800 over the past year, and production costs come out to at least $800 per pound. In short, in some markets it’s basically impossible to stay afloat.

Without laboring the point, dispensaries and especially growers are going to have a very difficult time if the industry doesn’t collectively decide to increase the cost for consumers. And, unsurprisingly, a recent survey suggests that around 30% of cannabis retailers will be increasing their prices to account for inflation, by up to 10%. This won’t be an easy thing to do, and based on our survey, it’s likely that there will be some reduction in profit as a result. However, the survey also shows some definite wiggle-room in terms of price, and that many customers will remain consistent.

It has also been a tough year for the cannabis industry overall, with sales declining towards pre-pandemic levels. In the pandemic, stay-at-home orders and people generally not having much to do boosted the cannabis market, but now people are getting back to work and purse-strings are tightening. It’s unfortunate for sales to decrease, but it would have likely been the case even without inflation.

What the Industry Needs to Do

To survive or even thrive in these difficult economic times, businesses need to make some difficult decisions and put a little faith in consumers. Our survey suggests that about 54% of consumers would buy less weed if prices increased due to inflation, but less isn’t none, and 77% of these would only buy a bit less, not a lot less. It isn’t ideal, of course, but with prices increasing for everyday products anyway, most customers would at least understand the reason for it. This is especially the case if businesses were up-front about the reason.

Industry insiders have some tips on how exactly to make ends meet in these difficult times, and there are many things you can do without increasing prices. These tips are:

- Focus on automation, digitalization and streamlining to save time and money.

- Give your budtenders the knowledge and talking points they need to address common customer concerns.

- Cut costs on hardware and packaging where possible.

- Layoff or freeze hiring when needed – it’s not ideal, but if other employees can pick up the workload it will save you a lot of money.

- Use pricing strategies and think about consumer psychology.

None of these are things you want to do, but the current climate makes it difficult to stay in business, and sometimes, difficult decisions need to be made. If rising prices is unavoidable, coordinate with other dispensaries where possible: you’re all in the same boat, and if you can raise prices as a group, nobody will lose out. This is especially important for growers in states like Colorado with rapidly declining wholesale prices.

What the Government Needs to Do

Unsurprisingly, legalizing cannabis at the federal level is the main thing the government should do. Not only would this likely be a big boost to the national economy, it would also open up many opportunities for growers and sellers to start doing business outside of state lines. This could ease pressures on more established markets, because an abundance of supply means lower prices if you’re stuck in a single state, but if you can divert some of the excess to an emerging market, supply will even out and prices won’t be continually driven down in the original state. Colorado has too much weed for Coloradans, but if you bring Texas into the mix, say, demand could even outstrip supply.

Of course, we shouldn’t assume that such a relatively simple action would rectify the issues with inflation more broadly. Cannabis, even though it could be a boon to the national economy, is only a relatively small piece of the overall picture. Combined with other methods for controlling inflation, such as using a contractionary monetary policy (i.e. raising interest rates), there is much more potential for controlling inflation than for any one approach individually.

However, the scale of economic benefit legalization could have still shouldn’t be brushed aside so easily. In a single swoop, it would create jobs, generate tax revenue, save money on enforcement and improve things drastically for existing growers and dispensaries. And with inflation being an increasingly-serious issue for Americans, any steps that can be taken to ease the damage should be carefully considered.

Conclusion

Inflation is a problem throughout the economy right now, and as much as dispensaries and growers might want to keep prices the same, the current situation is undeniably unsustainable, and companies are starting to see it too. Our survey suggests that while increasing weed prices would lead to some reduction in purchases, generally speaking, about half of existing dispensary customers would buy the same amount or even more. This is especially true for everyday smokers.

Plus, there is an unavoidable difference between what people say they would do and what they’d really do when push comes to shove. It’s easy to say you’d cut down on your purchases if the prices went up, but when Friday evening rolls around, how many would really forgo their usual joint?

We’ll find out soon, with 30% of dispensaries set to further raise prices. The major concern for these companies will undoubtedly be the other 70% taking their customers because they were willing to forgo profit to keep their prices down. Without some agreement at a local level, this will likely be a source of some friction among dispensaries and growers.

The broader problem of inflation is likely to continue for some time, especially if it brings on a recession, and any steps that can be taken to help the economy through this difficult time should definitely remain on the table. We might not get the full “ending prohibition fixed the Great Depression” result that we might hope for, but every little really does help.

The real question is a simple one: can the government continue to ignore a lucrative source of revenue as the economy crumbles around them? Is the current legal system benefiting anybody apart from the prison system? Should we have even waited until the economy was circling the drain to start having this conversation in earnest? The best time to plant a tree is 20 years ago; the second best time is now.

To stay up to date with the latest CBD Oracle News insights and updates, follow us on Twitter.

View complete survey question responses (PDF download).

Survey Methodology

The survey was conducted through Pollfish, and we got a sample of 1,450 Americans in adult-use states who use cannabis regularly. This works through partner apps, so respondents are genuinely interested in the topics they complete surveys on, which results in more reliable results than “surveys-for-coupons” systems or random dialing. You can read more about this here.

The results here have been “post-stratified.” This essentially means they have been adjusted to account for differences in the gender and age breakdown of the sample compared to the general population. By adjusting the results in this way, they’re made more likely to apply to the whole population. In practice, the differences were also very small.