With the news that the FDA has issued warning letters to companies selling delta-8 THC products, as well as eight so far this year relating to CBD, the future of the hemp industry seems in doubt. Through late 2018 and 2019, CBD was all the rage, attracting very little criticism and being broadly accepted as a minor issue at best. But things started to change when delta-8 and, more recently, hemp delta-9 entered the picture. Unlike CBD, they can get you high – that’s the whole point – and lawmakers are shifting their view of the industry. Does this mean the end for legal hemp? Are there any similar situations we can use to predict how the FDA and lawmakers are likely to respond?

We’ve put together this analysis based on our own lab studies, market research and conversations with industry stakeholders, as well as historical actions by the FDA, laws enacted in places like Colorado and California and things the FDA has said about hemp and CBD.

Key Findings

Overall, the hemp industry has enjoyed a period of relative freedom so far, thanks to the positive reputation of CBD. However, delta-8 and hemp delta-9 are forcing the FDA’s hand, along with medical claims and inaccuracies in labeling. While the FDA appears to be searching for a new approach for hemp, the industry needs to take action to prevent the sort of harsh restrictions e-cigarettes, synthetic cannabinoids and caffeinated alcoholic beverages ended up with.

- The FDA has consistently opposed unproven medical claims about CBD, and sends warnings to companies illegally adding it to food products

- The rise of delta-8 brought a lot of negative attention to the hemp industry, as lawmakers rushed to stop this unexpected, intoxicating form of hemp

- E-cigarettes were always less well-liked than hemp, and the FDA tackled this by requiring pre-market applications which are costly and far from a guarantee you’ll be able to remain in business

- Like the “delta-8” loophole, vaping companies tried to use “synthetic nicotine” to escape the FDA, but the loophole was slammed shut pretty quickly

- Caffeinated alcoholic beverages rose to popularity quickly but the FDA dashed them out of existence too, because caffeine is not approved to be added to alcoholic beverages

- Synthetic cannabinoids like JWH-018 had about three years in the spotlight, but were outlawed in 2011 in response to several related deaths across the country

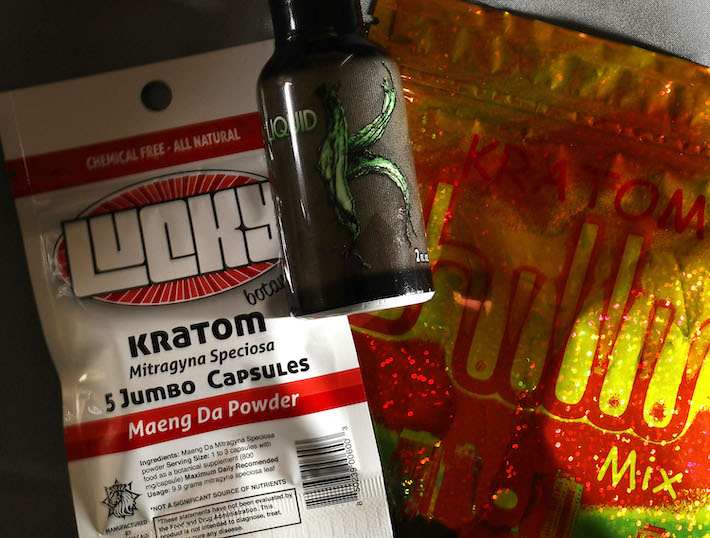

- Kratom, like CBD, is unapproved but has many supporters. Despite attempts to ban the substance, so far it’s not been possible and the FDA is currently seeking new powers to effectively regulate it

- Despite the FDA’s cautious positivity towards CBD, unproven medical claims remain a significant issue and until very recently, they believed it should be regulated as a drug

- Enforcement has, thus far, focused on companies making unproven medical claims, and it is likely to remain the focus

- In the coming year, more states are likely to pass bills limiting the THC allowable in hemp products (e.g. 2 mg of total THC per serving), more warning letters will be sent out and class action lawsuits are even possible

- Further in the future, it’s likely that the FDA will require some form of pre-market application for CBD products, although probably based on a new regulatory framework

- They will likely take steps to establish reliable, consistent testing guidelines and inspect more hemp production facilities on a regular basis

- Closing the loopholes is easy; regulating hemp logically is a challenge. The FDA will take their time, unless poor behavior by the industry forces their hand

- The industry needs to be proactive to avoid further intervention. Market hemp as hemp and cannabis as cannabis. Cannabis belongs in a dispensary, but hemp should be widely available

Hemp Products in the US: A Timeline

It’s helpful to look at what’s happened so far with hemp products before considering how things are likely to develop.

2017

Although some people were aware of CBD before, the rise in popularity really started in 2017, which is easy to see from Google search trends. There were already plenty of products on the market, and the FDA sent our four warning letters in 2017, all of which were related to medical claims made by the companies.

2018

The Agricultural Improvement Act (usually just called the “Farm Bill”) was passed in 2018, which was really the moment the CBD industry was born. This bill legalized hemp at the federal level, with the proviso that the plant can only contain up to 0.3% delta-9 THC on a dry weight basis. This also removed THC in hemp from the Controlled Substances Act (CSA). However, any products would still need to meet the requirements of the Food, Drugs & Cosmetics Act (FD&C Act).

Epidiolex, a CBD-based medication designed for rare childhood seizure conditions, was approved by the FDA on September 27th, 2018. This is a key moment because it means that CBD is officially recognized as an approved (medical) “drug,” which means that under the FD&C Act, it cannot be added to food products. This becomes very important as the issue develops.

2018 only saw one warning letter from the FDA, related to medical claims made and good manufacturing practices.

2019

Searches for CBD peaked in May 2019, and around this time the FDA held a public hearing and contacted industry stakeholders. Their goal was to gather information about CBD and get higher-quality data about it, and this is when the industry truly got their interest.

In contrast to the relatively calm years before, they sent out 22 warning letters to CBD companies in 2019. As before, this was almost entirely for companies that made medical claims on their websites or social media, with just a couple of exceptions. However, alongside these complaints, 77% of warning letters also mentioned the FD&C issue when it comes to CBD in food.

2020

In 2020, consumer interest began to shift a little. Delta-8 THC started to attract interest in April, with Google searches starting to rise, among the declining (though still much higher volume) CBD searches. The FDA held a stakeholder meeting in July to get their views on quality and safety of the marketplace, and how it should be monitored. In addition, they sent out a total of 21 warning letters throughout the year, but 15 of these were specifically because of COVID-related claims on companies’ websites and social media feeds.

It’s also worth noting that while delta-8 still attracts more interest, searches for delta-9 (likely due to hemp delta-9 started creeping up in 2020 too) are catching up.

2021

In January 2021, FDA research found that less than half of CBD products were within 20% of their stated dose, based on 200 products. They didn’t send many warning letters out, with just five in the year and all for medical claims (among other issues), because there was a new cannabinoid making waves in the market.

Delta-8 searches continued to rise through 2021, and Colorado became the first state to effectively ban delta-8 in May. This started a little wave of bans and similar limitations across the country. This varied a lot by state, though, with some being far stricter than others. The searches hit a peak in November.

The FDA and CDC both issued warnings about delta-8 in September 2021, and this prompted other states to take actions to close the “loophole” and crack down on the industry. This led companies to simply pivot to other cannabinoids, and consequently, as delta-8 searches declined, delta-9 searches continued to rise.

2022

2022 seemingly sees the FDA increasing the scrutiny for the industry again, with 13 warning letters having already been sent out. These are primarily for medical claims and COVID-specific claims, but 6 of them so far have mentioned the FD&C Act “food argument” too. Although 8 were for CBD companies, the remaining five were either additionally or exclusively selling delta-8 products. In short, the FDA now is paying special attention to delta-8, but it’s important to remember that CBD-related letters are still the most common.

E-Cigarettes, EVALI and Shifting Deadlines

One of the more instructive alternative issues to consider is the FDA’s response to the e-cigarette market, particularly at the time of the outbreak of vaping-associated pulmonary injury (otherwise known as “electronic vaping associated lung injury” or EVALI) and recently with products made from synthetic nicotine.

Although the key concept of an e-cigarette was invented long before, interest in e-cigarettes started to really rise around 2009, reaching peaks in September 2009 and September 2013. Much like the hemp industry, there were many years with no meaningful regulation and where companies existed in a quasi-legal state of limbo.

However, there is one key difference in this case it’s worth noting before we go much further: e-cigarettes were always viewed with quite a lot of suspicion. CBD might have some opponents, but it’s always had much more widespread support than vaping products. This was compounded by reports from the FDA about contaminants and annual statements from the CDC warning of an “epidemic” of youth vaping.

Pressure mounted from anti-smoking NGOs and lawmakers for the FDA to step in and regulate the industry, and in 2014 the FDA finally announced their “deeming regulations” for e-cigarettes, which took effect in 2016. This basically required companies to submit a pre-market approval request if they wanted to continue selling products after a certain date.

While this may seem very reasonable – regulations are usually a good thing – the application is supposed to demonstrate that the marketing of a product is “appropriate for the protection of public health.” This is hard to do with anything, but with something you use to inhale nicotine, it’s a very tall order. The sheer number of applications companies would need to submit, and the expense of each, was enough to force many out of the industry. So far, all but one of the accepted applications are for companies with at least some Big Tobacco investment.

The submission date was delayed to August 8th, 2022, but after a legal challenge in 2019, this was pushed forward to September 9th, 2020. While this was mainly due to the CDC’s continued calls for concern about youth vaping (plus an additional extension due to the pandemic), shortly afterwards, vaping’s opponents got an even better reason to urge haste: the EVALI outbreak.

While initially, the lung illness cropping up across America was genuinely mysterious in origin. And people were getting sick and dying around the country, with 2,807 hospitalizations and 68 deaths during its course. However, reporting by outlets such as Leafly quickly identified the cause as vitamin E acetate, a thickening agent used in (illicitly-sold) THC cartridges. Nicotine vaping was not involved, which is why the outbreak was concentrated in North America.

Even after this had been established beyond all reasonable doubt, agencies continued to make vague statements implying that nicotine vaping may have had a role to play. For instance, both the CDC and FDA still have statements suggesting that the causes have not been fully established and talking about non-THC vaping.

Seemingly in response to this outbreak, the Trump administration stepped up enforcement against unapproved, flavored (i.e. not tobacco or menthol flavored) cartridges. The outbreak was totally unrelated to nicotine vaping, but it was used as a reason to hasten enforcement regardless.

Synthetic Nicotine E-Liquid: How the FDA Approaches Loopholes

While the overall picture with nicotine e-liquids is definitely interesting and provides some insight into how regulators treat such new industries, one story is especially applicable.

The deeming regulations for e-cigarettes rest on the “deeming” of e-cigarettes to be tobacco products, which brings them under the FDA’s existing jurisdiction. This is because although the liquids used in e-cigarettes don’t contain tobacco itself, their nicotine used is derived from tobacco. So the idea was floated that if companies were to use synthetically-derived nicotine, this would mean they wouldn’t be tobacco products and would remove the FDA’s authority.

This led to many companies selling non-tobacco nicotine e-liquids, and continued speculation that the loophole could save the industry. However, that hope was dashed in March this year when they made it unavoidably clear that they will still regulate these products and slammed the loophole closed.

The parallel with delta-8 and hemp delta-9 is clear. Both of these exist as a way to get intoxicating products into the legal market using the Farm Bill, which was strongly intended to be for “rope, not dope.” While the letter of the law allows for this type of thing right now – as it once did for synthetic nicotine liquids – they can easily re-establish this intention by amending a small rule, as President Biden did for synthetic nicotine. The “loophole” is a detail: limiting the maximum THC (of any type) allowed per serving would slam it closed immediately.

Caffeinated Alcoholic Drinks

Drinks like Four Loko, Joose, Sparks and Tilt offer another cautionary tale for the hemp industry. Mixing alcohol with energy drinks and caffeine had already been popular on college campuses, but three Ohio State students decided to turn this into a business in 2005, founding Phusion LLC and creating Four Loko. It gained quite a lot of steam because people could stay energetic while drinking, keeping them in the mood to party.

However, the drink was in a similar position to CBD or delta-8 in food, for example, because the FDA has not approved caffeine as an additive to alcoholic beverages. The drink was rising in popularity right through to 2010, when the summer saw songs such as “So Loko (4 Loko Anthem)” on the charts, but the downsides of mixing caffeine and alcohol started to catch up with them. After 17 students and 6 guests got sick at Ramapo College in New Jersey in September, 9 ended up in hospital at Central Washington and many others joined over the next couple of months, the FDA took action.

They sent warning letters to four companies (including Phusion), giving them 15 days to remove the caffeine from their products. As states started to come down with bans in response to stories from colleges and elsewhere, it started to get banned from campuses, and the companies were facing an FDA crackdown, the industry shrank away into obscurity.

Synthetic Cannabinoids (K2/Spice)

Synthetic cannabinoids have existed for some time but first came onto the scene in the US in 2008. This can refer to a range of “research chemicals” which affect the same receptors as cannabis while technically being different to THC, the controlled substance. One of the most well-known is called JWH-018, which was created in the 90s by John W. Huffman (hence the name), who personally warned about the drug in 2009: “Do not use this stuff. We don’t know how toxic it is.”

While the drugs were gaining popularity, many cases such as that of David Mitchell Rozga started to emerge. Rozga, by all accounts successful, popular and non-suicidal, ended up killing himself after smoking K2, which he bought from a local mall with some friends. While there were many similar stories surfacing at the time, Rozga’s was clearly the main motivation for passing the 2011 federal law banning specific synthetic cannabinoids, because the law mentions him by name. Many states also took their own action in the wake of these events.

However, the 2011 law only focused on some specific substances, with the more wide-reaching Synthetic Drug Abuse Prevention Act being signed in by president Obama in 2012. While there have been some continuing issues – and other cannabinoids to add to the banned list – the legal story is essentially over from this point onwards.

In 2018, though, there were alerts from the FDA and CDC about the use of brodifacoum (an anti-coagulant, also used in rat poison) in synthetic marijuana products. This led hundreds of people – from 10 states, especially in the Midwest – to experience severe bleeding and related issues, as well as issues with the contaminated blood donations.

The consequences in all of these cases are much more severe than you’d expect with any product from natural hemp, but it does show that lawmakers and the FDA are more than willing to step in if there are potential issues. And again, it shows that “loopholes” allowing intoxicating products to be sold tend to be closed pretty quickly.

The Chaos Surrounding Kratom

Another instructive issue for those wondering about how the FDA will approach CBD is the situation with kratom. This is a plant which grows in Southeast Asia and acts on the opioid receptors, like prescription medications including oxycodone and morphine. The effects at low dosages are more like stimulants, while at higher-doses it takes on an opioid-like synthetic effect. Advocates point to differences between opioids and kratom, but the FDA and other organizations point to potential risks like respiratory depression, weight loss, constipation and nervousness.

This produced some controversy, because many people – including an estimated 10 to 16 million Americans – use kratom for pain relief, treating addiction and many other purposes. Perhaps unsurprisingly, the FDA issued alerts in 2012 and 2014, referring to kratom as an unapproved drug and about it being a new dietary ingredient. In 2014, at the FDA’s request, U.S. Marshals seized over 25,000 pounds of raw material used to produce kratom, followed by two seizures of kratom-containing products in 2016, for a total value of over $5.5 million. In 2021, there was another seizure of dietary supplements and ingredients either containing kratom or that simply were kratom, with a value of $1.3 million.

This might seem like consistent opposition to kratom, but the full story is a little more complicated. In 2016, the DEA attempted to label the active ingredients of kratom as Schedule I Controlled Substances. However, this was met with fierce backlash from ordinary citizens, members of congress, advocates and scientists. Just over a month later, they walked back from the ban, instead requesting public comments until December of that year. The ban did not go ahead, but the FDA maintained its hostile stance, regardless. In 2021, they sought public comments on whether to recommend a kratom ban to the WHO.

The legal situation for kratom is similar to that for CBD and hemp-derived delta-8 THC, in particular because the FDA insists that it cannot be classified as a dietary supplement. Many manufacturers have attempted to register kratom in this way, but all have failed. One legal expert who had worked with a firm intending to register kratom in this way commented that, “[The] FDA is hostile to the ingredient, and that means you have an extremely high bar.”

Much like with vaping, the approach to kratom seems to have been rooted in raising the barrier for market entry so high that few would be able to join even if they tried to. Four states have passed bills with regulations for kratom (Nevada, Utah, Arizona and Georgia), and others have banned it, but in most cases the drug is still in legal limbo.

Just last month, FDA Commissioner Dr. Robert Califf said that the agency needs new authority from congress to regulate both kratom and CBD, which fall through the cracks of the current legal framework.

What the FDA Has Said About CBD

In order to understand what’s likely to happen in the future of hemp, it’s crucial to look into what the FDA has already said about CBD. Generally speaking, the FDA appears to treat CBD with some caution, but with some notable interest regarding more potential medical applications. They seem to be holding the issue at arm’s length, but certainly appear open to other approaches to the substance.

First off, the FDA has expressed many of the legal opinions we’ve covered already. In particular, they’ve emphasized that CBD is a drug (Epidiolex), and this means that the FD&C Act restrictions apply to adding CBD to food. They’ve also restated that the Farm Bill effectively legalized hemp derivatives, provided it’s under 0.3% delta-9 THC by dry weight.

The FDA is generally open to CBD’s potential benefits, but this is tempered with a concern about potential risks. They stress that their main goal is to educate the public about the risks and unknowns around CBD products, and to gather information around potential medical benefits. They also point to several specific issues, including drug interactions, potential liver injury, male reproductive toxicity and other side effects, as well as the lack of knowledge around the needs of special populations. They note:

This does not mean that we know CBD is unsafe to these populations or under these circumstances, but given the gaps in our current knowledge, and the known risks that have been identified, we also are not at a point where we can conclude that unapproved CBD products are safe for use.

They’ve had public hearings and requested comments many times, and are actively gathering information and data on CBD. In particular, they’re looking for data on the long-term (or cumulative) effects of CBD, its sedative effects, how different methods of taking CBD affect risks, information on its pharmacokinetics (including transdermal use), more detail about how different preparations are extracted and what exactly they contain.

In terms of enforcement, their words match their actions pretty well. They are mainly concerned when there are significant risks, especially with regards to medical claims. For instance, they state:

“We have seen many CBD products being marketed with claims of therapeutic benefit, such as treating or curing serious diseases such as cancer and Alzheimer’s disease, or other drug claims, without having gone through the drug approval process. The proliferation of such products may deter consumers from seeking proven, safe medical therapies for serious illnesses – potentially endangering their health or life.”

The part we’ve bolded is key here. By potentially discouraging people from using established medical treatments, CBD products making medical claims could be doing harm. This is why they step in for cases where companies make medical claims, but otherwise, they generally leave the industry to continue business while they formulate an appropriate approach. They explicitly state that they’re looking at “risk-based enforcement,” and intend to make the process more transparent.

The ultimate goal for the FDA is to work out what to do about CBD. They favor the full “new drug” approach in some sense because CBD is basically being used as a medicine. But they also seem to appreciate that there is significant demand for it outside of a strict medical context, and are open to “exploring” the possibility of other frameworks. While saying this, though, they list a few issues they have (e.g. what are the long term risks? What is the dosage?) and point out that they’d have to be addressed.

Most recently, FDA Commissioner Robert Califf said that “I don’t think the current authorities we have on the food side or the drug side necessarily give us what we need to have to get the right pathway forward. We’re going to have to come up with something new. I’m very committed to doing that.”

After some information-gathering, it seems the FDA is preparing to establish something new altogether for CBD.

Short Term Outlook for Hemp – What’s Coming in 2022

The short term outlook for hemp will likely follow the path laid out so far, with lawmakers and organizations focusing on safety, quality, effectiveness and monitoring of hemp products.

FDA Warning Letters Incoming

In particular, it’s likely that the FDA will send out more warning letters. Since 2017, they’ve sent out an average of 11 letters per year, and although they’ve already exceeded that in 2022, it’s likely there are more to come. Warning letters aren’t evenly spread, with most years either having around 5 letters or closer to 20. This year, there have already been 13, but it’s likely that at least one more batch will be sent out. This year could even beat the 2019 high-point of 22 letters. As in all previous years, these letters will probably focus on companies that have made medical claims, likely combined with FD&C Act claims regarding CBD or delta-8 in foodstuffs.

Delta-8 companies are the most likely to be hit by the next letters, although many of these also sell CBD and these products may also be in violation of one or more laws.

FTC Warning Letters Are Also Possible

It’s also possible that the FTC will send out more warning letters about deceptive marketing claims, as they last did in May 2021. These letters are always in reference to health claims made by CBD product manufacturers. Such claims are also common for delta-8 products, and given the hype around the substance, it’s likely companies will receive some for delta-8 as well as more for CBD.

More State Laws Will Pass on Hemp

There are probably more state regulations coming for hemp products. For example, despite delta-8 really taking off last year, 20 states have already restricted or banned it, with four more currently reviewing its legal status. In the absence of federal guidance, this process will continue this year. Generally, either states haven’t addressed delta-8 specifically, have explicitly banned it, or – more rarely – have incorporated it into their existing legal cannabis framework (such as in Michigan, for example).

For hemp more broadly, there are a few specific types of law we’ll likely see more of in the coming year.

- THC Limits Per Serving: The rise of hemp delta-9 is only a factor because the Farm Bill doesn’t limit THC content, just its concentration. States such as Colorado will likely bring in THC limits for serving size (and for any THC, not just delta-9), following SB22-205. This is likely to include a figure of around 2 mg total THC per serving as a limit. The US Hemp Roundtable has recommended civil penalties for violations, and also that in-process extracts and ingredients (i.e. extracts in a form not yet intended to be sold) should be exempt from those restrictions. Other states will likely bring in similar laws.

- Bans on Chemical Conversions: Both delta-8 and hemp delta-9 products actually depend on chemical conversions from CBD, rather than using naturally-occurring THCs in the plant. Banning this process – as has been done in Colorado – is one way to control intoxicating hemp products. More states will follow this course of action through the rest of the year.

- Required Lab Testing: Colorado is again leading the way with requirements likely to be taken up by more states in the coming months, requiring lab testing of each batch of hemp products they intend to sell. This is already a de facto requirement because of consumer expectations, but it’s expected to increasingly become a legal requirement too.

Misleading Labels Will Invite Class Action Lawsuits

This year might also bring many lawsuits for the hemp industry. Class action lawsuits are pretty likely, because it’s been well-established (from our own analyses and others) that hemp products are often mislabeled in some way. This is really inviting issues, especially for companies selling intoxicating products. It’s very dangerous – and frankly, careless – to sell intoxicating products with substantial differences between what’s advertised and what customers actually get.

The Hemp Advancement Act

There is also a federal bill, the Hemp Advancement Act, which aims to clarify and improve on the language in the Farm Bill. In particular, it would increase the THC limit to 1% for the plant and any extracts, while still keeping the 0.3% dry weight limit for finished products. It would also expand the definition to refer to the “total tetrahydrocannabinol concentration,” which includes delta-8, delta-10 and any isomers, along with delta-9.

Pushes for Safety and Efficacy Checks

We’re also likely to see more safety and efficacy efforts than over the past year, likely including a couple of key components. Firstly, a product quality check and quality assurance program would give customers more confidence in the industry, and would enable higher-quality hemp companies to stand out from the crowd. In addition, mandatory post-market surveillance may be on the horizon. This would simply be a toll-free telephone line, staffed 24/7 by either health care practitioners or state-licensed pharmacists, capable of detecting, assessing, understanding and preventing adverse effects or other drug-related issues.

The Return to THC

Finally, it’s likely that the popularity of low-THC CBD will continue to decline, which will incentivize companies to increase the THC available in their products to whatever the legal limit is. Of course, this is dependent on any THC limits passed into law, but in the absence of such guidance the trend will be towards more THC, not less. This, in turn, will increase pressure for legislators to enforce a limit.

Long Term Outlook for Hemp – 2023 and Beyond

For the longer-term, all eyes turn towards the FDA. They’re well aware that they need to come up with a regulatory approach appropriate for CBD, particularly with the (understandable) hesitation for companies to opt for trying to get their products approved as medications. However, if it’s left to the FDA, it’s likely there will be more similarities with the situation for e-cigarettes than most hemp advocates would like.

Pre-Market Applications are Likely, But How High Will The Bar Be?

A pre-market application approach, as with vaping products at the moment, seems like a real possibility. The challenge for vaping companies was that the amount of data they have to gather for these applications is huge, and the cost of each application (which is required for each SKU) will drive many smaller businesses out of the industry. This will likely be accompanied by tighter restrictions for online sales.

A more optimistic version of the above would likely still require some type of pre-market application, but if the agency is genuine about wanting something more unique for hemp products (and kratom, incidentally), the requirements may be relaxed and the hoops companies have to jump through be made more manageable. It’s very unlikely that hemp will have an “EVALI” moment or lead to issues in the same way as synthetic cannabinoids or caffeinated alcoholic beverages have, so there might not be much motivation to enforce such strict requirements.

Unproven Medical Claims Will Continue to Be Challenged

However, it’s almost certain that the FDA will remain very concerned about unproven medical claims, and will continue enforcement against any products found making claims without evidence. This concern will likely lead to strict marketing requirements and officially-issued guidance to ensure products aren’t making health claims. This ties in with restrictions on what companies will be allowed to claim on their labels too. Additionally, regulators will likely require warning labels to any hemp THC or intoxicating hemp products. This might be a variation on the cannabis universal symbol or a unique warning.

Limiting Youth Access to Hemp Products

Lawmakers will also take steps to tackle the issue of youths gaining access to hemp products. The most likely is a requirement for an adult signature on delivery of any hemp product. Additionally, as with e-cigarettes, limitations on packaging and design will be likely imposed to reduce the appeal of the products to children. Flavors aren’t likely to be as big an issue with hemp, but there is a possibility that restrictions on flavor will come in future too.

Lab Standards and Tracing Systems

The increased requirements likely coming for those manufacturing, marketing and selling hemp products will necessitate more clarity on what is acceptable lab practice. Groups like ASTM are already working on creating universal standards for lab testing of cannabis products. This might sound a little dry, but this testing is the only way to verify that products are safe and that they give customers what they promise. Our conversations with labs show that while most do a great job, there are definitely some less reliable ones out there too.

Along with focusing more on ensuring lab results are reliable, there’s also a need for a tracing system. The differing treatment of marijuana and hemp under the law, despite it being the same species, makes the source of the CBD in the oil – for instance – very important. In the longer term future, all hemp products will be traceable in this way.

Monitoring of the Industry and GMPs

There will likely also be more ongoing monitoring of the industry in general. This includes active checking for potential adulterants, but also enforcement of current Good Manufacturing Practices (cGMP) in hemp product manufacturing. This usually takes the form of inspections of manufacturing facilities, and the FDA has already done this for hemp products.

How Should the FDA Get Solid Safety Information on CBD?

One of the main concerns the FDA has is the lack of knowledge surrounding CBD (and hemp more generally) when it comes to safety, adulterated products and other similar issues. This is one of the areas where they’re looking for information, and there are many good suggestions for tackling this.

- Use currently-available product stewardship programs – one example is from the National Center for Natural Products Research at the University of Mississippi and Safety Call International – to help develop standardized GMPs. This can also help with ongoing safety surveillance, reporting to regulators and identifying any adulteration.

- Require products to register. This is already being considered for supplements, and would provide the FDA with some initial information on each company and their products.

- Incentivize companies to participate in safety or quality stewardship programs by offering conditional registration.

How Should the Loophole Be Closed?

As a bare minimum, the loopholes created by the Farm Bill should be closed. Just closing the loophole is actually very simple, but producing a good system going forward is much more challenging.

- Limit THC Per Serving: By instituting a maximum THC serving of 0.5 to 2 mg per serving, the loopholes created by the 0.3% delta-9 by dry weight requirement would be immediately closed. As states already have, this limit should be for all THC, not just delta-9. This alone fixes the parts that feel like a “loophole” in some way – most delta-8 and hemp delta-9 products would be immediately outlawed.

- Make Packaging Consistent and Clear: Any guidance on labeling will help customers understand what they’re buying and packaging should be child-resistant. At minimum, a clear CBD and THC dosage per serving should be on every product.

- Account for All Intoxicating Cannabinoids: As mentioned above, any law limiting THC per serving should account for delta-8, delta-10 and many other alternatives, as well as delta-9.

Summary

The FDA knows people like CBD, and probably see that it has many benefits and promising evidence in other areas too. They know they could crush the majority of the industry by taking a really close look at their product or manufacturing process. But that hasn’t happened. They could have used their FD&C Act powers to remove every single edible from the market. But they didn’t do that either.

It’s not that they don’t know; it’s that they don’t really care. Delta-8 and hemp delta-9 likely push their buttons a little bit more, but regardless, their focus has been consistently on companies making questionable claims. For the majority of the industry, they’re happy to sit back and gather data while working on some approach that will please both concerned politicians and enthusiastic CBD oil users.

The future likely holds some more nuanced regulatory path for things like CBD to follow. Intoxicating hemp will either be banned or incorporated into existing marijuana programs, but CBD will probably stick around in a very similar form to now. There will never be an equivalent of EVALI to scare congressmen. Instead, CBD is the type of thing your grandma might have a drop of to get to sleep at night.

And that, truly and honestly, is the difference. CBD’s reputation is more like that of natural medicine than cannabis. And even though hemp basically is cannabis, it will continue to be treated like a source of rope. That is, unless companies abuse this temporary “loophole” much more and make the whole thing seem more sinister.

The problem for the industry is a simple one: if companies don’t stop making false (or unsupported) claims, mislabeling their products and allowing bad practices to continue, the cautious positivity the industry has enjoyed so far will evaporate. Delta-8 and hemp delta-9 companies in particular need to pay heed to this warning, but CBD companies need to keep their guard up too.

Criticize the FDA all you want, but if you’re selling your products on false hope and false claims, you’re practically inviting a crackdown. The true tragedy is that customers deserve better, and it shouldn’t be on the FDA to ensure they get it. It’s time to take responsibility.