Although inflation is down from its peak in June, the current overall rate of 8.3% is still wreaking havoc on the economy. Part of the reason for this is because it isn’t spread evenly – gas, for example, rose by 49% between January and June this year – and it will remain a problem for a lot longer than we might like. After our investigation into how this has impacted the cannabis market, though, one question is still hanging in the air: does cannabis really help local economies? And if it does, how? Should other states consider legalizing weed to insulate the local economy from wider risks like this?

We’ve spoken to economic experts and taken a deep-dive into the data to answer these questions and more. While legal cannabis might not be the definitive solution for inflation and recessions, the evidence and the experts suggest it could be a valuable addition to other strategies.

Summary

- Inflation currently stands at 8.3%, with higher costs for things like energy (23.8% inflation) and increases in costs for dispensaries and growers.

- Most dispensaries haven’t raised prices, largely due to an over-supply of cannabis, but 30% will be increasing prices soon.

- While CBD Oracle’s survey showed that 54% of consumers overall would buy less weed if prices increased, of people who smoke every day, 51% would buy the same amount or more.

- Legalizing weed is a substantial economic benefit to states, usually generating hundreds of millions in tax revenue and creating tens of thousands of jobs.

- Economic resilience describes an economy’s ability to withstand economic shocks like inflation and recession, and a cannabis industry boosts local economic resilience.

- States with no legal weed market experience 5% higher inflation, relative to states with a legal weed market. The saving, for a pre-inflation spend of $1000, is equivalent to a month’s Costco membership.

- The media and social media influencers should focus more on local economies and boosting resilience to help tackle inflation.

- Customers can vote with their dollars: spending more at locally-owned dispensaries boosts the economy.

- The federal government could create $128.8 billion in revenue and 1.6 million jobs over 7 years by legalizing cannabis.

The Cost of Inflation for People and the Industry

The overall Consumer Price Index (CPI) figure tracks inflation through the cost of a “basket” of goods, compared to the same time the year before. While this hit a high of 9.1% in June, it currently stands at 8.3% for the difference between August 2021 and 2022. However, this figure is still concerning on its own, and more so because some areas are harder-hit than others. For example, food is 11.4% more expensive and energy costs have risen 23.8%, and both of these are necessities. The impact of this on ordinary Americans has been brutal, and in our survey, over three-quarters of people said they’ve either been slightly (43.7%) or greatly (31.6%) affected.

The increase in costs also directly impacts the industry. Energy price increases, for example, make transporting stock and even keeping the lights on in dispensaries more expensive. For growers, even things like plant pots and fertilizer have increased in price, for the latter by 25% in just a few months. You would assume the solution is simple: raise prices to make up for the impact of inflation. But things aren’t that simple in such a competitive marketplace.

Why Aren’t Dispensaries Raising Prices to Compensate?

As Andrew Livingston, Director of Economics & Research at Vicente Sederberg explained to us:

“In large part, companies are not increasing their prices even though they are experiencing an inflation in their expenses (labor, non-cannabis input ingredients, cost of capital, etc) because the pressures of supply and demand within the cannabis market are acting in a stronger way to push down prices than inflation is placing on production costs.”

He pointed out that the pandemic was a relative boom for cannabis businesses as people stayed at home, then continued, “Over the last few months demand has waned as consumers rebalance their purchases across products and experiences and reduce both as inflation cuts into their pocketbook. With supply remaining at its pandemic high and demand falling, an oversupplied legal cannabis market puts downward pressure on prices.”

In short, even though companies would like to raise prices to account for greater costs, inflation is fundamentally driven by demand exceeding supply (as explained by John Oliver using a stock of bizarre frog water fountains), and in the case of weed, the supply is still pretty huge. Reducing prices then feels like a gamble, or even a death sentence, since your competitors can easily sweep up any lost customers.

The situation for growers in Colorado really sums this up. Sales declined 25% from April 2021 to April 2022, but at the same time, the wholesale flower price has declined 43%. Chris Becker, from the Honeybee Collective, commented to MJBizDaily that with wholesale prices down to $800 a pound, “It’s been a tough year for cultivators. Most people built their businesses around getting at least $1,500 a pound.”

The cost of production, comparatively, is $800 to $900 per pound. If you’re a small cultivator or are just unable to absorb such a loss for a long period of time, it is impossible to remain in business in such a climate. Things have got to change. And as well as 57% of the respondents to our survey saying prices have already increased, 30% of dispensaries are reportedly planning on increasing prices in the near future.

How Cannabis Consumers Will Respond to Continuing Inflation

How cannabis consumers respond to inflation or recession is a central question regarding whether the industry will help through a recession, as Dr. Chris Erickson, economics professor at New Mexico State University, said to us:

“The ability of the cannabis sales to insulate an economy from a recession depends on how cannabis sales respond to a decline in income. The sensitivity of products to a recession varies. The evidence as to how cannabis sales will vary with changes of income is limited, but what I could find indicated that cannabis sales are relatively stable. This means, all else the same, a local economy that has a relatively large cannabis sector will be more stable. Of course, there can be many compounding factors.”

Our results concur with his analysis. For our survey, we spoke to 1,450 American adults in legal states who consume cannabis regularly. While the results don’t look great for dispensaries, with 54% of respondents saying they’d buy less if weed prices rose as a result of inflation, but the news wasn’t all bad. In fact, 51% of daily smokers said they would buy the same amount (38.6%) or even more (12.4%) if cannabis prices suddenly increased due to inflation.

It’s clear that different cannabis users respond differently to price increases. The people who smoke every day are obviously more likely to continue with about the same frequency. In contrast, of the people who smoked regularly but not every day (between 1 and 5 days per week), 57.5% would buy less if the prices increased due to inflation.

The results invite comparison with how alcohol use changed over the 2008-9 recession. While there was a slight decline in “any” alcohol use, from 52% in 2006 to 51.6% in 2008-9, the rate of frequent binging rose from 4.8% to 5.1% over the same time period. In short, while the financial difficulties reduced the amount that most people drank, there was a subset that increased their drinking substantially.

Although the situation for cannabis isn’t likely to be exactly the same, you can see the same divisions in the data. Sure, the 49% of less frequent, but still regular smokers will cut back with inflation, but the 51% of daily smokers are more likely to stay consistent or even increase their use. Profits will decline, surely, but there is clearly a subset of smokers who can keep dispensaries afloat, even with price increases.

The Cannabis Industry and Local Economies

It should go without saying that having a cannabis industry is generally beneficial to the economy. Without even going into detail, it’s obvious that switching a black market to a legal, taxed one will lead to a big increase in revenue for local governments. Colorado is a great example of this, as the first state with recreational dispensaries. The year after sales became legal, in 2015, Colorado’s gross domestic product (GDP) grew 4.4%, then 2.4% in 2016, 3.1% in 2017 and 3.5% in 2018. The state was still outpacing the rest of the country in growth in 2020, and it had one of the five lowest unemployment rates. By mid-2020, 41,144 people were directly employed in the marijuana industry in Colorado.

Because all cannabis sold in a state must be produced in the state, cannabis commerce has a greater economic multiplier than most other industries.

The reason for this goes beyond just getting additional taxes. You also have job and business opportunities, and a lot of money saved on the enforcement of what is increasingly being recognized as a pointless prohibition. The fact that everything is concentrated in a single state also boosts the impact, as Andrew Livingston pointed out to us:

“Yes, cannabis sales will benefit local economies as the money spent on cannabis goes on to pay employee salaries, local contractors, and suppliers. Because all cannabis sold in a state must be produced in the state, cannabis commerce has a greater economic multiplier than most other industries. The cannabis products sold in a Denver retail store are much more likely to be cultivated, extracted, and manufactured in Denver than the goods sold at an ordinary Denver convenience store.”

And it isn’t just Colorado that saw such a benefit. In 2021 (unless otherwise stated):

- Alaska took $30 million in taxes and fees

- Arizona took $219 million

- California took $1.3 billion

- Illinois took $387 million in cannabis taxes, compared to just $291 million in alcohol taxes

- Massachusetts took $177 million

- Michigan took $169 million in 2020 and $247 million in 2021

- Nevada took $158 million

- Oregon took $178 million

- Washington collected $559.5 million

Additionally, the full economic impact also needs to account for job creation. Oregon’s industry, for instance, has more than 12,500 jobs, which translates to $1.2 billion in economic activity for the state, and in 2020, the Washington industry generated $1.85 billion in gross state product and supported 18,700 full time equivalent jobs. And all of this is without considering savings on law enforcement costs.

Although a report on legalization from the Cato Institute generally concluded that the marijuana industry has a limited impact because it’s small in comparison to the whole state economy, the data clearly shows there is an impact. In the final chart of Figure 12, where legalizing states are compared with the non-legalizing states in terms of GDP growth, a gulf opens up between the two groups when legalization stated in 2012. Legal states have more economic growth than restricted ones.

As Dr. Erickson argued, the location of the cannabis market is also important, with some areas generating more cannabis tourism because they’re so close to a state without legal weed:

“For some locations, cannabis can contribute significantly to the local economy. In this regard, often cited are stores located near jurisdiction boundaries where only one jurisdiction has legalized cannabis. Cannabis sales to tourists can be a significant source of income to the local community.”

Why Local Economies Matter in a Recession

Local economies tend to do better in recessions if they have higher economic resilience. This is the term for an economy’s ability to prevent, withstand and recover from economic “shocks,” like national or international economic events (e.g. inflation and recession), natural disasters and downturns in important industries for the region. There are two types of initiatives for economic resilience: steady-state and responsive. As the name suggests, responsive initiatives are comprehensive plans to respond to such shocks when they arise.

Steady-state resilience initiatives are longer-term approaches to maintaining resilience, such as broadening the base of industries in the region by boosting or allowing for emerging markets. Creating and supporting a cannabis industry falls into this group, because a downturn in one area (e.g. people spending less on gas) may not be reflected in cannabis purchases. It’s important to note that these effects often primarily operate locally, such as the closure of a large manufacturing plant in a small town. Although the wider industry might be experiencing a slight downturn, the region will be hit much harder as substantial numbers of citizens lose their jobs.

It makes sense that having a legal cannabis industry would improve economic resilience for a state. However, the impact of this depends a lot on the overall size of the economy, as Andrew Livingston pointed out:

“The degree of the stabilizing effect depends on the size of the local economy. With a small economy cannabis sales and taxes may represent a large portion of local commerce and if those sales stay strong could help to stabilize the town’s economy in a significant way. For larger cities like Denver or Los Angeles, cannabis commerce makes up a much smaller percentage of the total city GDP and as such will have a stabilizing effect, but it will be much smaller given the size of the market.”

So, even if the actual impact is harder to notice in some cases because of the overall size of the economy, the stabilizing effect from the cannabis industry is still present. It would be a little optimistic to think it was a one-size-fits-all solution, but it looks like it can definitely be one component of the steady-state resilience that economies need.

Does Inflation Vary for Legal Weed vs. Illegal States?

As part of the analysis for the survey and the previous post on the topic, we looked into the differences in the inflation rate for states with some form of legal weed industry vs. those without one. Previously, we’d compared states purely on the basis of whether they had legal recreational weed, but this had a couple of issues. First off, some states (like New York, for instance) have legalized recreational weed but haven’t yet created a legal supply chain for recreational users. And secondly, medical marijuana also generates revenue and should really be considered when looking at the economic impact.

With this in mind, we compared the inflation rate in August 2022 (or July otherwise) for states with at least legal medical marijuana to those with neither medical nor recreational marijuana. The results do show a small difference, with more inflation in states with no form of marijuana industry. Overall, among the states with some form of legal weed, inflation was at 9% in August 2022, compared to 9.5% in states without any form of legal weed. The absolute difference may be pretty small, but relatively speaking, this means there is 5% less inflation in states with legal weed.

| Market | Inflation Rate |

|---|---|

| States with a legal cannabis market | 9.0% |

| States without a legal cannabis market | 9.5% |

This basically means that for an average “basket” valued at $1,000 in August 2021, for states without legal cannabis, the current value is $1,095, whereas in states with some form of legal cannabis, it is valued at $1,090. From this, it’s clear that the difference is still quite small. However, over a year at this rate, the person in the state without a weed industry will have paid $60 more in inflationary costs alone, compared to the one in legal or medicinal state. For a consumer, this is the cost of a year’s Costco membership, for example.

As discussed in the previous section, the difference is expectedly quite small. In most places, cannabis simply won’t make up a big enough chunk of the economy to really affect things too much. However, adding a cannabis industry to your overall strategy is certainly beneficial in times of economic hardship.

How “Legal” Are Legal States, Really?

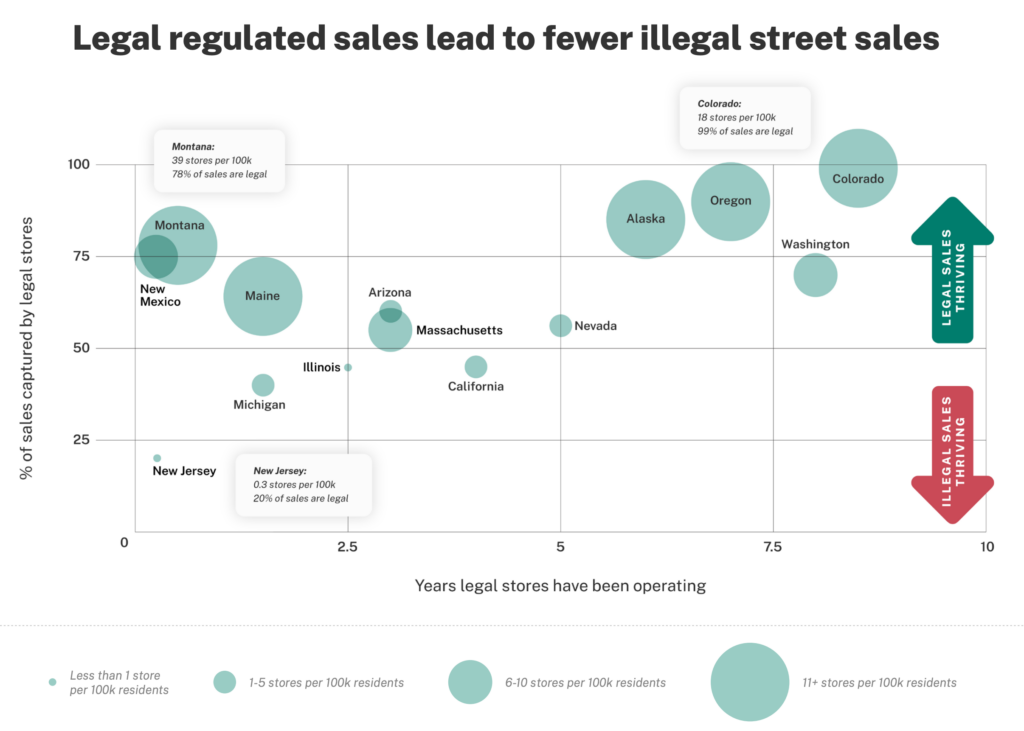

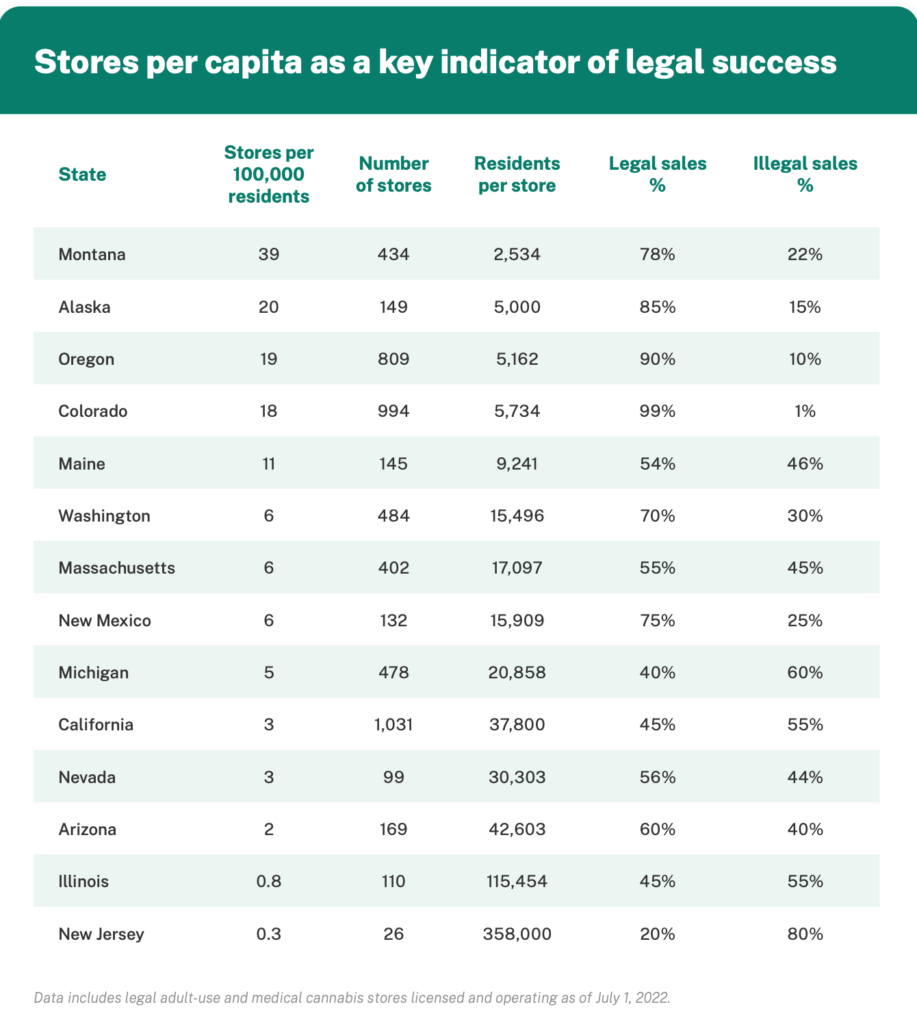

Leafly’s recent report on “opt-out” towns raises an interesting issue for our analysis of legal vs. restricted states, and even on the financial benefits of legalization. They point out that the amount of legal cannabis purchases depends strongly on the number of legal dispensaries per 100k residents.

Even without taking the most extreme examples, the issue is clear. Oregon has 19 dispensaries per 100k, and the report estimates 90% of sales are legal. In California, there are 3 dispensaries per 100k, and only 45% of sales are legal. New Jersey is the worst for this, with 0.3 stores per 100k, and a massive 80% of the market is illegal.

The issue is essentially that in many adult use laws, localities have the option to “opt out” of having cannabis businesses in-state. However, weed is still legal there, and the street dealers were already there. Although not wanting to become a pot tourist paradise like Amsterdam is understandable, the reality is that opting out only helps the illicit market. You can try to crack down all you like, but the weed is even easier to get access to than before and your citizens – even if you think they don’t – still want to smoke it.

If you make it so the closest safe, regulated, taxed, ID-checking dispensary is too far away, they will buy from the unsafe, unregulated, untaxed, never-ID-checking dealer down the street. People want to buy legally, but if you don’t give the option, they can keep doing what they were before.

For our analysis, this likely means two things. First, the amount of money to be gained from wholehearted legalization is likely much bigger than we’ve quoted here. In California, for instance, most of the market is still untaxed and doesn’t create legitimate jobs. So the $1.3 billion figure for taxes is probably lower than it should be – with more dispensaries it could have easily been $2 billion or more. Secondly, the economic impact in terms of a reduction in inflation is probably also understated. The money being spent isn’t stimulating the legitimate economy; it’s boosting the illicit economy.

In short, the reality of legalization is probably even better than it looks.

Addressing the Issue: How Influencers, Media, Consumers and the Government Can Help

Of course, everyone really wants to get inflation under control. There are many broader approaches that can be taken at the national level, or even other more local-level solutions, but it’s also important to think about how even cannabis consumers can help the situation through using their purchasing power.

How Influencers and the Media Can Address Inflation More Effectively

While everyone would like a simple, top-down solution to inflation, unfortunately this isn’t exactly likely to emerge. This is why it would be useful for the media and social media influencers to focus more on local-level resilience and sustainability, rather than pointing the finger at Biden, Putin, Trump or anyone else with a larger political role. Resilience operates locally, and the solutions to building resilience also operate locally.

Talking about the benefits of economic resilience, especially at the local level, is vastly better than placing blame on certain figures for what they’ve done or haven’t done. Local governments should, in particular, look at their current risk management policies, and identify the areas in which their economy is vulnerable. For example, maybe your city is too focused on a single industry, or maybe house prices are rising and putting pressure on residents, or maybe a lot of people are dependent on credit for their month-to-month expenses. Identifying and addressing these issues makes localities more resilient and thereby improves how well they deal with economic shocks.

The media and influencers should:

- Focus more on local issues. People can actually make a difference here and it keeps suggestions concrete.

- Encourage diversification of industries. Encouraging new businesses to open in areas focused around a single industry is a very pro-business and pro-community way to protect against economic shocks.

- Promote local businesses. Having local businesses on the high street is great, but for them to help the economy, they need to get enough customers through the door. If you like a company, promote them.

While these aren’t exactly the most exciting things to post about, it would be a valuable addition to whatever makes up the bulk of the site or social media feed.

How Customers Can Help: Vote With Your Dollars

Whether you’re a cannabis customer or just an ordinary citizen looking to do something to help with inflation, the easiest way to exercise your power is through where you spend. This is true well beyond just shopping for cannabis, because spending money at locally-owned businesses helps out your area. If you’re buying weed, picking a local, independent dispensary is the best approach for the same reason. The more that money goes to big, out-of-state businesses, the less your spending helps to build resilience in your region.

For cannabis, as mentioned above, the fact that everything has to remain in-state makes the impact of your purchases much more obvious. By picking up a bag, you’re supporting the grower, the dispensary and anyone in the supply chain along the way, all of whom are in your home state. While spending on things where supply is limited (e.g. fuel) can push inflation even further (since you’re driving up demand on the same limited supply), for weed, supply is less of an issue and purchases support the economy in several ways.

How the Government Can Help: It’s Time to Legalize

It’s been estimated by New Frontier that legalizing cannabis at the federal level would bring in $128.8 billion over the course of seven years, with a 15% retail sales tax. In the same way that repealing prohibition helped the country out of the Great Depression, it’s possible that legalizing marijuana could give the economy a much-needed boost before things get that bad again. In the first year after prohibition was repealed, alcohol and other excise taxes brought in $1.35 billion for the government, absolutely dwarfing the $420 million it got from income taxes.

While legalizing marijuana wouldn’t have that much of an impact in the modern world – after all, many state governments do make money from marijuana already – it’s undeniable that the roughly $18 billion per year would help the government in these times of hardship. Not only that, it would generate new business opportunities for people around the country. In addition, ending federal prohibition would enable growers in over-supplied states like Colorado to move some of their products to newer markets, supporting the other state’s supply while earning more for what they grow. Like local legalization, it would also ease strains on police and their budgets.

In the same New Frontier estimate, they found that legalizing cannabis at the federal level would create 1.6 million new jobs over the same seven-year time period. Again, while this figure, split over the years, wouldn’t single-handedly bring us out of this mess, it would be another boon for the economy at a time when one is desperately needed. As always, when it comes to weed laws, the question is more “why not?” than “why should we?” There are plenty of reasons we should, but very few good arguments for the current system.

Conclusion: Think Locally and Vote With Your Wallet

There are no simple solutions for the situation we’re in. With the war dragging on and the world still reeling from the shock of COVID, there are undoubtedly still tough times ahead. But as consumers, if you can still afford to vote with your wallet, we collectively have the power to make a difference. Re-framing the issue as one for localities is crucial, and with that in mind, you can choose to support the local businesses that will stimulate the economy.

This is what makes cannabis perfect: you’ll be supporting growers, independent dispensaries and giving the government revenue, all by just getting high. Most of all, you’ll be showing that it’s one of the many industries that can build an economy’s backbone, and allow them to pull through and even thrive when times get tough. It could become an industry of resilience.